Green steel production: How G7 countries can help change the global landscape.

Key messages

- Steel production accounts for 8% of total global CO2 emissions. Emissions from steel production must decrease for industry to achieve net-zero emissions by 2050 and for countries to deliver on the commitments made in the Paris Agreement.

- The steel production landscape is changing: seven out of the ten biggest steel producing countries have initiated at least one green steel project, according to the Green Steel Tracker. So far, the projects are concentrated in economic regions with ambitious climate reduction targets.

- G7 governments should accelerate the ongoing change process by coordinating policies to create markets for green steel, pool and scale-up investments in research and development, deploy and scale-up green steel projects and increase investment in multilateral funds dedicated to industrial decarbonization.

Download

Read the brief (pdf)

A race to be the world leading green steel producer is expected and companies should expect governments to engage in the race, according to the authors of the study. Photo: Kateryna Babaieva / Pexels

Our global society is built on steel

From major infrastructure to buildings, and cars to kitchenware, steel plays an important role in our daily lives. Steelmaking is highly emission-intensive and the nearly 2 billion tonnes of steel produced every year generate around 8% of global CO2 emissions.

But current process technologies are not in sync with the Paris Agreement’s commitments and objectives. Process emissions must fall by at least 30% by 2030 to bring the sector in line with a 2050 net-zero trajectory.

Why modern steel production is so emissions-intensive

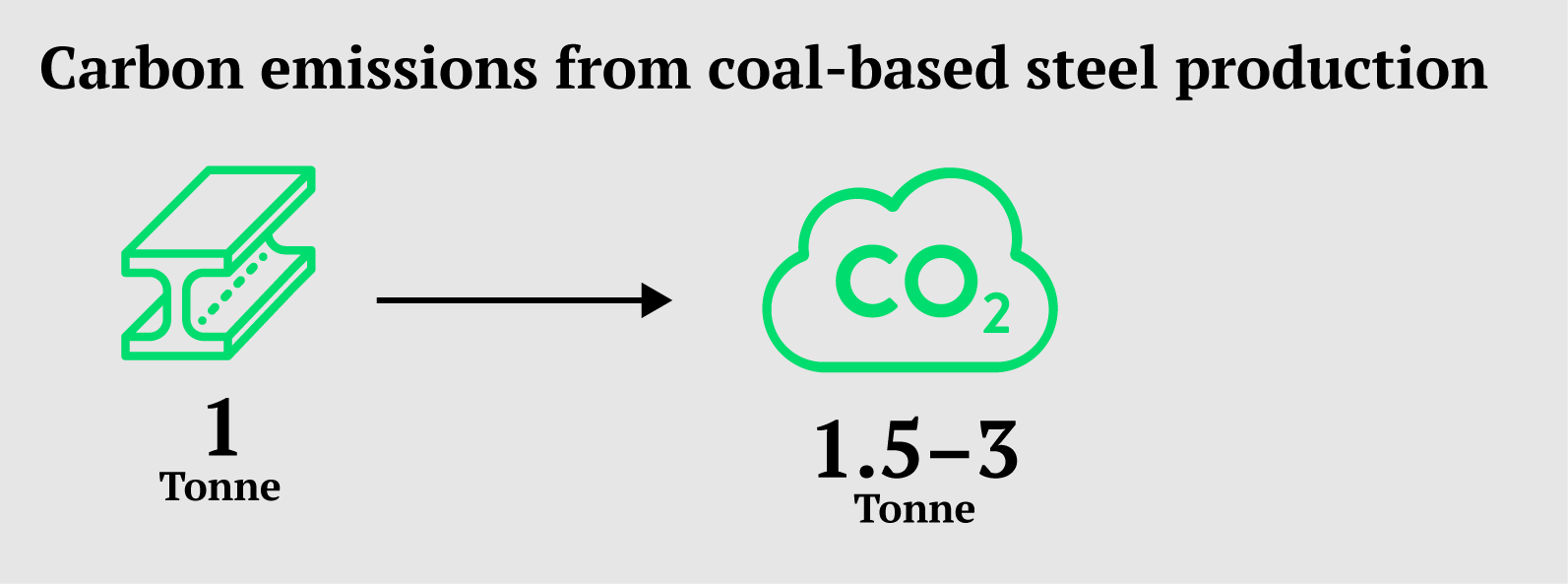

Today, most crude steel is produced by reducing iron or using coal. The industry’s blast furnaces are highly energy intensive and rely on fossil carbon as a fuel and reduction agent. For each tonne of steel produced in the conventional blast furnace-basic oxygen furnace route, between 1.5 and 3 tonnes of fossil carbon are released into the atmosphere.

Recycling seems to be the most obvious way to reduce emissions: steel is recyclable and about 22% of globally produced steel was made by remelting scrap with electric arc furnaces (EAF) in 2019. But the full potential of reused and recycled steel is currently unfulfilled. Recycled steel tends to be of lower quality, due to poor sorting and contamination issues. Huge innovations are underway to overcome these barriers; nevertheless, most steel demand in the future will likely still be met by primary production facilities.

30% by 2030

Current steel production generate around 8% of global CO2 emissions. To bring the sector in line with a 2050 net-zero target, process emissions must fall by at least 30% by 2030.

Green steel production is possible

We need to change the way we produce steel. Alternative technologies have been under development for the last few decades. Natural gas and hydrogen can be used for the direct reduction of iron ore (DRI-EAF). Companies and innovators around the world are researching electrolysis technologies and testing carbon capture in pilot and demonstration projects. A huge amount of effort is going into improving the recyclability of steel. However, these technologies have yet to transform the sector. Indeed, global steel production remains as emissions intensive as it was 20 years ago.

The Green Steel Tracker reveals that steel production is changing. The Tracker, launched by a consortium of 10 leading civil society and research organizations, gathers public announcements of low-carbon investments in the steel industry.

The Tracker presents projects across 17 countries that use different decarbonization technologies and are at different stages in the innovation process. The picture that emerges from this work shows the following:

- Seven out of the ten biggest steel producing countries have initiated at least one green steel project.

- The five largest steel producing companies (ArcelorMittal, Baowu, Nippon, HBIS and POSCO) have at least one project on the Tracker’s list. However, many of the steel companies outside of the top five are absent from the list. For the group of the 6th to 10th largest steelmakers, only Tata Steel (#9, headquartered in India) is included in the dataset. The steelmakers ranked 6th to 10th In the list, each based in China, have yet to announce investments in steel decarbonization technologies.

Recycling seems to be the most obvious way to reduce emissions. But the full potential of reused and recycled steel is currently unfulfilled.

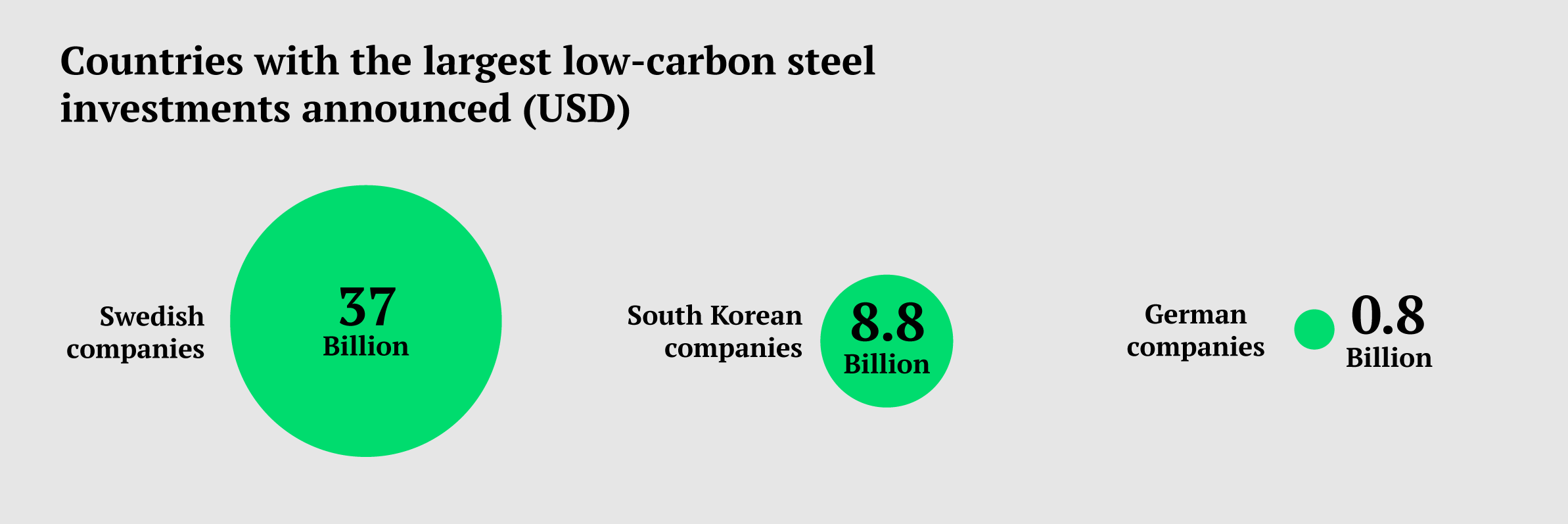

- About two thirds of the projects (31 out of 47) are in Europe, where the largest investments occur. Swedish companies have announced the largest share of investment (with $22-51 Billion USD for 6 projects), followed by a South Korean company ($8.8 Billion USD) and 11 projects announced by German firms ($0.8 Billion USD).* (See note)

- The scope and scale of the projects differ significantly, ranging from research and development partnerships to multi-billion-dollar announcements for new clean steel facilities. The Tracker shows that hydrogen technology pathways are most common among the steel producers, which means that demand for coking coal is likely to fall through to 2050. Enabling steel decarbonization through fuel switching will require rapid expansion of renewable energy generation to support hydrogen production by electrolysis.

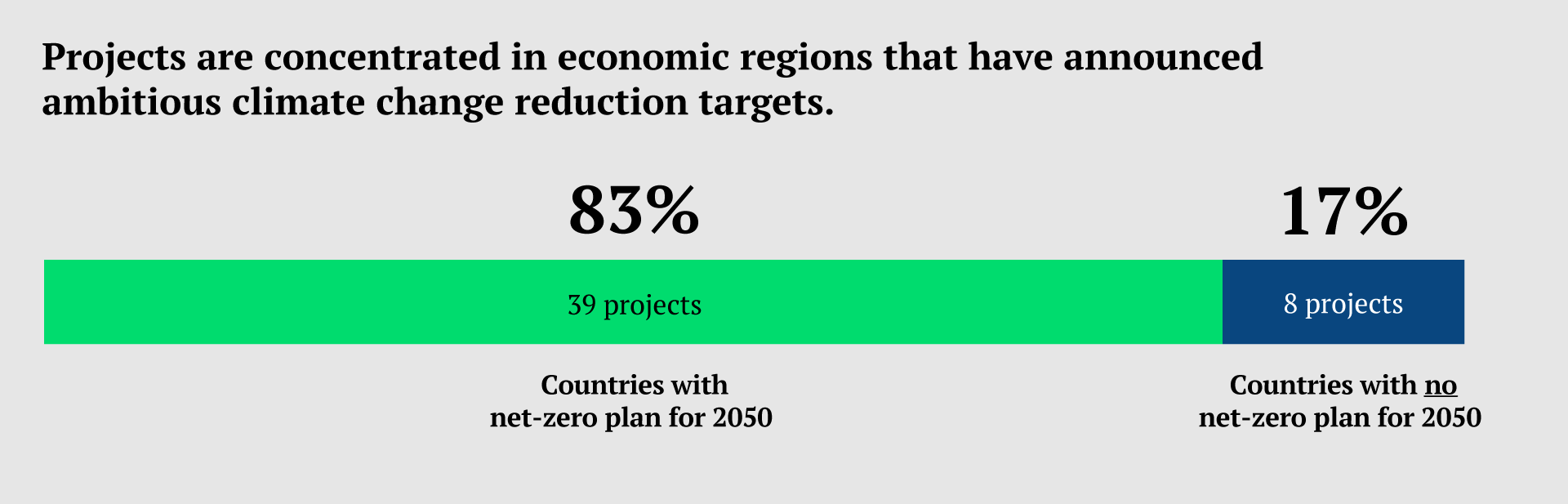

Projects are concentrated in economic regions that have announced ambitious climate change reduction targets. For instance, Sweden aims for climate neutrality by 2045 and accounts for the biggest investment volume that has been announced. Projects by Indian owned giants ArcelorMittal and Tata Steel are also located in European countries committed to climate neutrality by 2050. Only 7 projects out of 42 fall under the jurisdictions of countries without current plans for net-zero decarbonization targets by 2050. A race to be the world leading green steel producer is expected. To this effect, current decarbonization strategies and targets – as stated in the European Union’s (EU) Green Deal, South Korea’s commitment to climate neutrality by 2050, China’s pledge to net-zero emissions by 2060, as well as the United States’ recently proclaimed 2030 climate target of reducing emissions by 50- 52% – should all serve as wake-up calls for the steel industry and help to accelerate the transition process. Companies should expect governments to engage in a race to the top.

Demand is growing throughout the value chain

Consumers are also beginning to recognize the value of green steel for their businesses and are starting to signal their demand for green steel. For instance, actors like the Climate Group’s Clean Steel Buyers Alliance bring together key players from the construction industry in the UK. Elsewhere, companies such as Volvo Trucks will purchase hydrogen-based steel from Sweden’s industrial scale HYBRIT steel plant and the car manufacturer, Volkswagen, announced plans to produce electric cars with a 100% carbon neutral value chain.

National and local governments – including those of Germany, the Netherlands, California and South Africa – have included steel in green public procurement policies that set sustainability standards for products and materials purchased using government funds. In June 2021, UNIDO’s Clean Energy Ministerial announced the launch of the Industrial Deep Decarbonization Initiative (IDDI) which aims to commit 10 national governments to green public procurement policies for steel within the next three years. The entire manufacturing industry is starting to recognize that higher green steel costs have greater marketing and sales benefits compared to the relatively minor cost increase for final end-consumer prices for many products (generally below <1%). As soon as businesses pledge carbon neutrality beyond the direct scope 1 emissions, buying green steel will be their best option.

*Note: Figures are based on announcements captured in the Tracker which range from statements of intent to fully fledged commitments. This introduces an element of uncertainty due to the challenge of tracking the credibility and implementation of announcements. Due to the scale of transformation being proposed, investments cited in announcements may also include more than the direct investment required for new technology. For further details on methodology, please visit: https://www.industrytransition.org/green-steel-tracker/methodology-green-steel/

The risk of leaving behind emerging economies

The race is on, but not everyone can participate. There are major disparities in terms of access to finance, technology, skills and policy commitments, particularly in emerging economies. Ambitious projects in places such as Europe and South Korea receive public support and are backed by strong national commitments to the extent that policy makers plan to create legislative frameworks to guide transitions. At the same time, there is a risk that companies active in other regions are left behind. This puts global climate ambitions in jeopardy because it harms efforts by companies to forge green steel value chains which span the globe.

The need for greater coordination and international collaboration on industry transition is nothing short of critical. It is only through working together that the world can bring industrial emissions down to zero.

How the G7 can provide the groundwork for a global transition

Industry decarbonization is gaining unprecedented momentum, but not everywhere. While all the G7 states (Canada, France, Germany, Italy, Japan, the United Kingdom and the United States) and the EU have announced climate-neutrality commitments for 2050, their efforts are currently directed towards national and regional context. Joining forces on efforts can thrust industrial decarbonization into the spotlight of the international policy agenda. As the Tracker has demonstrated, steel decarbonization investments and innovations are likely to happen in jurisdictions or markets with a dependable policy environment. The latest G7 energy and climate communique sets the stage for a new industrial policy agenda, but this needs to be followed by actions. As heads of state and government gather for the 2021 G7 Leaders’ Summit, they need to signal top-level government support for this agenda.

G7 governments can make their contributions toward industrial decarbonization impactful through the following measures:

- Coordinated policies to create markets for green steel. The market for green and circular industrial products is still in an early phase of development. Demand side policies need to be put in place now. But they require aligned signals and harmonized procedures across our global supply chains. They need standardized, comprehensive calculation methods for reporting emission intensities. To make these calculations, researchers will need transparent data collection on blast furnace relining technologies, fuel use, capacity utilization, etc. Only then can the environmental impact of products be properly compared and understood.

- Think on a global scale, as green steel is traded internationally. The G7 countries combined come second to India and China in steel consumption. Building on existing corporate, national and international level efforts to set green procurement standards, G7 countries should commit to working together to develop harmonized product requirements and criteria for green steel and then connect them to ambitious public and private procurement goals. The Clean Energy Ministerial Industrial Deep Decarbonisation Initiative (IDDI) is looking for 10 national governments to commit to green public procurement policies for steel within the next three years with the first set of national commitments set to be announced at COP26. The G7 countries should join this initiative and pledge their support. A joint approach to create a policy framework that strengthens markets for green steel by the G7 and associated economic zones would send a strong signal and set a clear direction for the global steel sector. Underlying this process is the need to develop a transparent, science-based methodology for assessing and reporting on the emissions-intensity of steel production.

- Coordinate efforts to pool and scale up investments in research, development and deployment. Technologies for decarbonizing the steel sector are available, so the most urgent transition challenge is one of demonstration and deployment, rather than basic research. The Green Steel Tracker also underlines how many countries and companies are following similar pathways – focusing on hydrogen- based steelmaking. With a dominant decarbonization pathway, there is a clear case for G7 countries to pool and share resources to bring down the development costs of these technologies and ensure the diffusion of cleaner technology internationally. G7 countries should commit to supporting this initiative and set their own ambitious targets for investing in commercial demonstration projects and market deployment. In addition, G7 countries should invest in circular economy and demand-side innovation, such as measures to decontaminate scrap steel and innovation to decrease overdesign. Such innovations are crucial to bringing the sector’s emissions down to zero.

- Enable transition financing. Limited climate and public finances have been provided for the decarbonization of heavy industry sectors. Multilateral development banks (MDBs) are starting to shift their focus to industrial decarbonization, but they require additional funding to take this forward. The World Bank’s Climate Investment Fund, with participation from regional MDBs, has a new industrial decarbonization fund waiting for donor replenishment. G7 countries should scale up investment in multilateral funds for industrial decarbonization, call upon MDBs to mobilize targeted grant support and technical assistance for industry decarbonization and strengthen the Green Climate Fund to mobilize additional financing. The sum of total investments across all projects currently listed in the database amounts to $30 billion USD until 2030. Governments should fully back financial arrangements with policy schemes that cover some of the incremental costs for decarbonization.

It is only through working together that the world can bring industrial emissions down to zero.

Green steel production: How G7 countries can help change the global landscape

Authors: Timo Gerres (Comillas Pontifical University); Johanna Lehne (E3G); Gökce Mete (Leadership Group for Industry Transition, LeadIT, and Stockholm Environment Institute, SEI); Suzanne Schenk (Europe Beyond Coal Campaign); Caitlin Swalec (Global Energy Monitor)

This study provides a brief overview of the current state of the steel sector by using information from the Green Steel Tracker, an open database that tracks public announcements of low-carbon investments in the steel industry and presents them transparently in one place.