Reaching Net-Zero Industry through Public-Private Partnerships.

In this paper, we review some public-private partnerships and policy mixes that are receiving a lot of attention, including green public procurement, carbon contracts for difference, carbon border adjustment, industrial clusters, and climate partnerships.

We also examine how collective action among countries can send a stronger signal to businesses and investors. We provide case examples from South Korea (hereafter Korea), Denmark and Sweden and share experiences of the EU, Canada, and the UK in implementing some of the key measures.

Reaching Net-Zero Industry through Public-Private Partnerships is a joint study by the Leadership Group for Industry Transition (LeadIT) and the Green Technology Center Korea (GTC).

Download as pdf

Read the full paper

Decarbonizing so-called hard-to-abate sectors will not be easy, the authors write. To reduce emissions for heavy industries, major systemic shifts are needed. Photo: Yancy Min / Unsplash

Building global momentum for industry transition

Industry accounts for roughly 30% of global CO2 emissions and these emissions have been growing significantly as many countries around the world seek to industrialize. This places a significant imperative on industrial actors globally to reduce emissions sharply for the world to limit global warming well below 2°C, as required by the Paris Agreement.

Global momentum for industry transition is building, with public and private stakeholders across the world taking steps to decarbonize the sector. Among many nations, industry transition is becoming a top priority, and countries are putting in place roadmaps in the form of visions, pathways and action plans to provide advanced decision support for policymakers. Meanwhile, companies such as FLSmidth and HYBRIT are setting net-zero targets and promoting ultra-low-carbon technologies.

Recent years have also seen the development of a much-needed international collaboration to catalyse industry transition. Countries and companies are increasingly working together to set up policy frameworks and incentives. One example of this is the Leadership Group for Industry Transition (LeadIT), a collaborative initiative which gathers countries and companies that aim to achieve net-zero carbon emissions by 2050. It was launched by the governments of Sweden and India at the UN Climate Action Summit in September 2019 and is supported by the World Economic Forum. LeadIT provides an arena for public-private collaboration, and for sectoral and cross-sectoral learning, for example on innovation opportunities and new technologies.

Despite growing momentum and the development of low-carbon alternatives, decarbonizing the so-called hard-to-abate sectors – including steel, cement, aluminium, chemicals, plastics, metals and mining, aviation, and heavy-duty transport – will not be easy. Major systemic shifts are needed to reduce emissions for heavy industries, including:

- Increasing recycling and circularity

- Reducing demand through material efficiency

- Increasing energy efficiency along the whole value chain, and

- Reducing both the combustion and the process emissions from both primary and secondary production routes.

These major shifts call for large public support and the strong participation of private stakeholders. Governments can support the decarbonization of hard-to-abate industries through subsidies, high carbon prices, and robust public-private sector partnerships.

30%

Industry accounts for roughly 30% of global CO2 emissions and these emissions have been growing significantly as many countries around the world seek to industrialize.

An enabling environment for low-carbon energy infrastructure

Reaching net-zero targets in industry will require profound changes to infrastructure in order to reduce the carbon intensity of energy supply and capture process emissions. An enabling environment is critical for achieving this. More specifically, decarbonization of heavy industry calls for public-private cooperation to enable the following changes:

- The replacement of blast furnaces with a new system around hydrogen direct reduction for steel, shifting from fossil feedstock to “electric feedstock” for chemicals, or rebuilding cement kilns for capturing CO2 from flue gases,

- The use of biomass as an energy source for many applications in industry, with varying needs for further processing and substituting fossil feedstock for the chemical industry, and

- The building of infrastructure for supporting the supply of new energy carriers at scale, such as electricity, hydrogen or biogenic CO2 and the abandonment or repurposing of old infrastructure (e.g. harbours for coal, pipelines, oil storage sites).

Achieving these changes and reaching net-zero for industry first and foremost requires the creation of an enabling environment in the following key energy sources and technologies: hydrogen; carbon capture, utilization and storage (CCUS); renewable electricity; and biogas (see Annex I).

Creating an enabling environment entails profound changes to existing infrastructure and the development of new infrastructure to support these technologies. Despite differences in their application and readiness, the development of energy sources and technologies face common challenges such as costs, scale-up and competitiveness. Public-private partnerships are therefore crucial to address some of the major barriers to developing and deploying these energy sources and technologies.

Reaching net-zero targets in industry will require profound changes to infrastructure in order to reduce carbon intensity of energy supply and capture process emissions.

Measures to spur investment towards climate-neutral assets and infrastructure

Radical changes in infrastructure across energy and industry sectors will require active commitment from a range of actors from the private and public sectors to bring about the necessary investment in infrastructure and to re-allocate capital from carbon-intensive to climate-neutral assets and infrastructure. This section explores policies that public authorities could consider, in close collaboration with private stakeholders, to allow for this reallocation.

Incentive schemes and energy taxation

Because heavy industries are energy-intensive, creating an enabling environment for low-carbon energy infrastructure is closely linked to how energy is taxed. If renewable energy and hydrogen are to be produced at the right scale, the right taxation and levy system should be in place to ensure they are competitive with high-carbon options. Energy taxation needs to be discussed as part of national efforts to decarbonize industry so that renewable energy is on a level playing field with other energy carriers.

For instance, the tax treatment of gas and electricity in the EU is not harmonized across Member States, therefore it provides implicit subsidies for fossil fuels and certain economic sectors. It also impacts fuel competitiveness and undermines the carbon price.

These unequal levels of taxation carry the risk of deterring consumers from green products and energy sources.

Supporting low-carbon energy infrastructure requires taxes and levies, including carbon pricing, to be applied uniformly across energy carriers and sectors – or ideally so that they are more favourable to renewable energy. Policymakers may also want to consider how taxes are applied on electricity used for energy storage or for hydrogen production, with the aim of ensuring that energy is only taxed once, when delivered for final consumption, and to avoid unjustified double grid charges.

Carbon contracts for difference for new technologies

Among the support schemes and measures to support low-carbon energy infrastructure and decarbonization of heavy industry, the carbon contracts for difference (CCfD) policy option is perhaps the most recent, especially for refineries and fertilizer production, the chemical and steel industries, and shipping and aviation.

CCfD involves long-term contracts between private and public counterparts, and remunerates investors by paying the difference between the agreed CO2 contract price (also referred to as strike price) and the actual CO2 price in an explicit way, bridging the higher operation costs and risks for producing green steel or cements.

CCfD ensures that the carbon price is high enough so that decarbonization technologies become commercially viable and investible. Similar to the feed-in tariff system, CCfD would guarantee investors a fixed carbon price, and therefore a more predictable and bankable price. This enables a favourable business case for innovative technologies.

CCfD can be adopted at a national or regional level, and could be awarded solely on a project-specific basis to avoid these contracts being traded or fulfilled by a portfolio. A number of European countries are experimenting with CCfD, in particular to support the renewable hydrogen sector because it remains the most promising market-based mechanism to commercialize low emission projects. For example, Germany’s national hydrogen strategy unveiled in 2020 includes a pilot programme for CCfD in the steel and chemical industries.

Measures to address carbon leakage

There is a risk that policies and frameworks implemented to curb emissions from the industry sector could push companies to transfer carbon emissions to other countries with less stringent climate policies. This risk is known as carbon leakage, and below we explore some ways to address it.

Emissions trading schemes and free allowances in the EU and Korea

Emissions trading schemes (ETS) are market-based instruments that provide economic incentives to reduce GHG emissions through the issuing of GHG emissions allowances. These allowances can be traded by companies, and the cost of carbon is determined by the overall cap on emissions and subsequent market price for each allowed metric ton of CO2 below that cap. Some of the sectors may receive free carbon allowances within the ETS due their susceptibility to carbon leakage. The choice of the instrument will depend on national and economic circumstances.

The EU ETS constitutes the world’s first and largest carbon market. It covers a wide range of sectors, including steel, mineral products/cement and aluminium production. These industrial sectors are considered among the most vulnerable to carbon leakage.

Korea has implemented the Korea Emissions Trading Scheme (KETS), which accounts for approximately 70% of national GHG emissions. It the second largest ETS in the world, after the EU ETS.

Both in the EU and Korea, energy-intensive industries that are subject to international competition have been granted different levels of subsidy for renewable electricity and free emissions allowances (within the ETS) to level the playing field for them. Allowances can be allocated for free or put up for sale at auctions.

A carbon price signal that is high enough could close the pricing gap and drive climate-friendly investments. For instance, the EU ETS is due to be revised to be strengthened and to extend its scope. The revision will update the free allowance benchmark used for free allocation and the European Commission may consider how to further incentivize the production of renewable and low-carbon hydrogen, while taking account of the risk for sectors exposed to carbon leakage. This offers an opportunity to tackle the competitiveness of green products.

It is generally accepted that a more ambitious and predictable regulatory framework and long-term policy than emissions trading schemes offer would need to be adopted to promote investments into alternative technologies and create a market for green materials and products.

Free allowance allocations have been politically and economically more feasible than other measures such as the carbon border adjustment mechanism (see below) or full exemption from the ETS. However, while shielding energy-intensive industries, free allocations are considered to discourage innovation, lower the overall efficiency of the system and even result in carbon lock-in.

Carbon border adjustment (EU)

The concept of “border adjustment” typically refers to import levies or taxes imposed on goods imported by countries implementing stringent carbon policies, from countries with lower ambition for emission reduction. It aims to level the playing field between domestic and foreign firms by imposing the same economic burden on emissions. A carbon border adjustment could be adopted as a carbon tax on selected imported and domestic goods in the form of a new carbon customs duty or tax on imports or an extension of the ETS to imports. The Carbon Border Adjustment Mechanism (CBAM) could prevent carbon leakage by enabling the price of imports to reflect their CO2 component.

At the same time, the CBAM could be used as an instrument to incentivize the decarbonization of the industry. In some sectors, the CBAM may make more carbon efficient metods competitive (i.e. European chemical producers may cut their reliance on Russian crude oil and import more from Saudi Arabia, where extraction leaves a smaller carbon footprint).

A number of considerations need to be taken into account to allow for an effective CBAM. For the CBAM to effectively support decarbonization in the industry, policymakers need to give more visibility for investments in fuel switching and supply arrangements with suppliers (long-term contracts). Additionally, some challenges to the implementation of the CBAM would need to be carefully considered, including uncertainty over the administrative and methodological complexities regarding the calculation of the CO2 component of products, the likelihood of retaliation from trading partners and the risk of WTO incompliance.

The question of which direction the CBAM takes in the EU is very sensitive for the European industries that receive free allowance allocations. This is because if the CBAM is introduced, the free allowances would need to be removed (otherwise it may lead to over-subsidization). However, too soon a removal of these free allowances may put at risk the financial capacity of the industry to switch to expensive low-carbon energy, such as hydrogen. Hence, some sectors recommend a gradual reduction or simultaneous application of a border measure and the free allowances. This can in principle be done with the deduction of calculated carbon footprint from the carbon duty. However, the EU Green Deal indicates that only one tool will be implemented to deal with carbon leakage.

Allowance auctioning has the benefit of creating revenues for the government, which can be reinvested in innovative technologies (or to address distributional aspects, such as in California’s cap and trade system that uses auction revenues to ultimately offset customer cost increases). In the EU, a part of these revenues is channelled to the Innovation Fund, which focuses on innovative low-carbon technologies and processes in energy-intensive industries, including products substituting carbon-intensive ones, carbon capture and utilization (CCU), and the construction and operation of carbon capture and storage (CCS).

Carbon clubs

“Carbon clubs” have also been a suggested as a mechanism for “ring-fencing” higher cost markets for green products and materials and therefore circumventing risk of carbon leakage. Under carbon club agreements, governments would provide an enabling regulatory environment for green steel production via one or a mixture of the measures, such as Green Public Procurement (GPP) or CCfD, and the companies would commit the supply and demand investment knowing that a favourable market for a given product or material exists.

We can also talk about a carbon club where a green steel producer enters a long-term relationship with a car maker. The car maker then can pass the cost of green steel down to consumers for whom the additional cost is a small part of purchasing a car.

Alternatively, the formation of carbon clubs can emerge as a result of convergence of (or a formal link between) national systems of several countries or regions that have established a carbon-pricing system. The EU, Canada, California, China, South Korea and New Zealand have been in informal talks on cooperating for preserving their industry’s competitiveness by linking their ETSs and forming a carbon club. Globally, 20% of emissions are covered under 52 national, regional and local carbon pricing systems.

Convergence of ETSs can help shift the world toward a single, global carbon price and eliminate the need to adopt policies to address real or perceived competitiveness or carbon leakage considerations. It could provide incentives to other jurisdictions to implement carbon markets. However, there is also a risk that the adoption of carbon-pricing instruments across several regions would separate the world trading system between a world that is low-carbon, and another one that is high-carbon. Emerging economies Brazil, South Africa, India and China already share the “grave concern” that EU plans for a carbon border tax on imported products like steel and cement will unfairly penalise their economies.

In the energy-intensive heavy industries sector, there is a risk that carbon clubs would be concentrated only in a few countries, such as China, the EU, the US, Japan and India.

Carbon tax (Sweden)

A carbon tax directly sets a price on carbon by defining a tax rate on GHG emissions or – more commonly – on the carbon content of fossil fuels.

In Sweden, a carbon tax on energy sources has been the cornerstone of its national policy, which fostered energy efficiency and uptake of renewable energy. The carbon tax in Sweden is levied on all fossil fuels reflecting their carbon content. This means that actual emissions need not to be calculated.

In 2021, the rate of the carbon tax per metric ton of fossil carbon dioxide emitted is SEK 1200. The tax rate increases gradually and in a stepwise manner, therefore businesses and households have time to adapt. This rate also applies to the industry sectors that are outside the EU ETS. The parts of the Swedish industry covered by EU ETS are exempt from the carbon tax. Combustion of sustainable biofuels are also not covered as they do not result in a net increase of carbon in the atmosphere.

The Swedish carbon tax system is easy to implement at a low cost, because there are already robust revenue-collecting systems, such as systems for levying other excise taxes on fuels in place, and the tax rates in Swedish tax law are expressed in common trade units (volume or weight).

Similarly, a carbon added tax could be adopted, to act as a value-added tax for embedded carbon, corresponding to the amount of CO2 released for every step of the production. For products with a relatively low premium price associated with the decarbonization, such as steel, a consumption charge could meaningfully contribute to market creation for green steel.

Another alternative is a consumption charge at the domestic market, which would reflect a CO2 component and material efficiency of steel, aluminium and cement, based on an emissions benchmark. This would be only valid if a CO2 price were not included in the final producer price. The revenues collected can be directed to low-carbon investments, for instance via a national trust fund for climate action.

Other enabling measures and partnerships

Green Public Procurement

Green Public Procurement (GPP) is a process whereby public authorities use their purchasing power to acquire goods, services and works that have a low environmental impact throughout their life cycle. As public procurement of materials such as cement, concrete and steel is often significant, the introduction of green criteria in the procurement process could boost the demand for low-carbon products, with a proven willingness to pay from the public sector. Thus, this instrument could make the production of green materials more attractive for the industry sector.

To evaluate the environmental impact and compare products, GPPs would need to be accompanied by measurement and reporting standards such as Environmental Product Declarations (EPDs) or “low-carbon” or “carbon-neutral” labelling for the entire production chain. In the heavy industry sectors, labelling can be complicated, for instance because there are many types of clean steel, such as zero-emission virgin primary steel and recycled steel from renewably powered electric arc furnaces. In order to overcome this complexity, suppliers may be required to make standardized declarations.

GPPs should state requirements from bidders and how procuring agencies will incorporate environmental criteria into bid evaluation, through guidelines and mandatory performance standards. For procuring authorities to evaluate and compare the environmental impact of bidders, software tools are very useful. South Korea is a frontrunner in this domain with the fully integrated procurement system called KONEPS, which manages creation of procurement requests, tendering, contracting, payment, and reporting.

Policies that support GPPs require transparency and that rules are harmonized on embodied carbon measurement. Several industry labels exist today, such as ResponsibleSteel and SustSteel (Eurofer). The EU Product Environmental Footprint Category Rules (PEFCR) were developed under a pilot to define the climate impact of products over their lifetime (as well as in procurement procedures). The ISO published an International Standard for providing globally agreed principles, requirements and guidelines for quantifying and reporting the carbon footprint of a product (CFP).

Best practices include the voluntary GPP instrument in the EU relevant for purchases of low-carbon buildings and vehicles, but this lacks binding targets. Using this instrument, Member States of the EU may create a large demand base for green products. For instance, GPP has been used as an instrument of Swedish environmental policy for over ten years. The Netherlands follow the EU GPP criteria, with additions including price discounting using an evaluation software.

Another example is Canada’s Greening Government Strategy, which is a set of commitments that apply to all core government departments and agencies in support of the Government’s transition to net-zero carbon and climate-resilient operations, and includes commitments related to green procurement. More precisely, the Policy on Green Procurement requires that the procurement of goods and services actively promotes environmental stewardship. Achievements include reductions in GHG emissions of 34.6% for buildings and light-duty when compared to its 2005–06 baseline, and almost 300 buildings of the federal government real property portfolio are at net-zero carbon or net-zero ready.

GPP may come at a higher cost for green products, particularly for local and regional authorities. However, this may not always be the case depending on the methodology for calculating costs. In fact, green products may have a lower purchasing price due to production efficiencies associated with a smaller amount of energy and raw material use and waste generation. For this reason, life-cycle costing (LCC) is being applied by a number of public authorities. The LCC approach considers all the costs that will be incurred during the lifetime of the product, work or service.

Industrial clusters, shared infrastructure and circular carbon

Industrial clusters can play a crucial enabling role in helping countries achieve their emissions reduction ambitions. These large areas where companies from single or multiple industries are co-located are another great example of public-private partnership for improving the competitiveness of low carbon or carbon-neutral initiatives. While governments may support large scale infrastructure projects with capital grant and regulatory measures, clusters foster multi-stakeholder collaboration among companies across the value chain. The co-benefits of these clusters, beyond emissions reduction and maintaining economic competitiveness, include job creation and innovation through the creation of modern energy systems.

A number of decarbonization solutions are ideally suited for these geographical areas where these clusters are located. These are systemic efficiency, clean electrification, hydrogen and Carbon Capture Utilisation and Storage (CCUS). Indeed, almost onethird of planned CCUS projects involve the development of industrial CCUS hubs with shared CO2 transport and storage infrastructure. There are also several pilot and demonstration projects for blue and renewable hydrogen production taking place in industrial clusters in the Netherlands (Athos & Porthos), the UK (Teeside and Humber) and Germany. Companies can also exploit economies of scale allowed by these clusters to bring the costs down quickly, thereby triggering initial investments towards the creation of a market.

A number of decarbonization solutions are ideally suited for the geographical areas where clusters are located. These are systemic efficiency, clean electrification, hydrogen and carbon capture, utilization and storage (CCUS). Indeed, almost one-third of planned CCUS projects involve the development of industrial CCUS hubs with shared CO2 transport and storage infrastructure. There are also several pilot and demonstration projects for blue and renewable hydrogen production taking place in industrial clusters in the Netherlands (Athos and Porthos), the UK (Teeside and Humber) and Germany. Companies can also exploit economies of scale allowed by these clusters to bring the costs down quickly, thereby triggering initial investments towards the creation of a market.

Industrial clusters can also contribute to cutting emissions by fostering greater systemic efficiency and circularity through cross-entity waste utilization and the sharing of energy and material streams within a cluster. Additionally, benefits from shared infrastructure include solutions that enable direct electrification through micro-grids that provide power, cooling and heating, storage and flexibility.

The UK Government’s Industrial Decarbonization Strategy, announced in March 2021, focuses on job creation through retrofitting industrial sectors with CCUS and hydrogen, and aligning the industry with the UK national net-zero emissions target for 2050. In order to achieve this the government set out plans to transform five existing industrial clusters into net-zero or lower-carbon hubs.

If designed well, industrial clusters can bring multiple benefits, from supporting climate targets, improving air quality, economic competitiveness to green job creation and attracting regional investments. However, each cluster will have different circumstances and will require a different roadmap.

Lowering trade barriers: access to global markets

Lowering trade barriers to enable more open international trade and access to markets where carbon-neutral products can be sourced has been also credited for promoting carbon-neutral solutions. Indeed, there are examples where wind and solar have benefited from the creation of global markets.

A truly open and fair global market and level playing field would also shield against carbon leakage and help foster partnerships between energy providers and industry. Alongside this, countries may put in place GPP policies among themselves through bilateral trade agreements.

Investment in Research and Development

Policies that stimulate investments in R&D are pivotal to put the industry on track to reach net-zero by 2050. Investments need to drastically increase to ensure the necessary technological innovations are in place for the decarbonization of heavy industries.

Governments may like to consider providing subsidies for new and innovative technologies that have not yet made a market entry. However, R&D support should ideally be technology-neutral in order to let the market pick up the most promising options.

The business case for industry transition – example cases

Fossil Free Sweden (Swedish Initiative for Climate Transition)

Sweden is a global leader in building a low-carbon economy. By 2045, Sweden aims to reach net-zero emissions of greenhouse gases into the atmosphere, and thereafter achieve negative emissions.

In July 2011, the Swedish Government proposed developing a roadmap for attaining this goal. In 2015, ahead of the UN climate conference in Paris, the Swedish Government established the Fossil-free Sweden (FFS) initiative to bring together more than 170 actors from companies, municipalities, regions, and organizations to back the declaration that Sweden will be one of the first fossil-free nations in the world.

FFS has a unique coordination role between the business sector and politics – in the form of various ministries and parties – in facilitating public-private partnership and finding common ways ahead to speed up the transition to a fossil-free welfare nation. The initiative acts as a coordinator and provides a platform for dialogue and cooperation, both between the actors and between the actors and the government.

In 2017, FFS initiated a programme to cooperate with business and industry sectors to develop their own roadmaps for fossil-free competitiveness. The purpose of the roadmap process has been to support business and industry sectors to use a new tonality in which the business community is enabled to declare its willingness and ability to be fossil-free, provided that the politicians create the right conditions.

Commitment and targets: Through this program, 22 industry transition roadmaps were developed by the Swedish industry sectors to show how they can enhance their competitiveness by moving towards climate neutrality (i.e. net-zero carbon emissions). Industries set their own targets and milestones and are responsible for the visions and proposals to remove obstacles that are presented in their roadmaps. Some of the industry targets include the following:

- Fossil-free steel industry in 2045. HYBRIT, a cooperative venture between SSAB, LKAB and Vattenfall, is developing fossil-free steel that uses hydrogen instead of coking coal. This is expected to be on the market in 2035.

- The mining and mineral industry aim to have fossil-free mining operations by 2035 by investing heavily in electrification and automation.

- The cement industry wants to use Carbon Capture and Storage (CCS) on a large scale. If the conditions are put in place, this can be reality by 2030.

- Aviation has set fossil-free domestic air services by 2030 as a target, chiefly to be achieved with the aid of biofuel. In the longer term, electrification will also be part of the solution.

- The heating sector aims to become climate positive with the aid of CCS technology in biopower stations (BECCS, Bio Energy Carbon Capture and Storage).

Challenges to fossil-free competitiveness: The lack of economic incentives and terms, commodity availability, prioritization and competition, political will, coherence and regulation were identified as challenges to fossil-free competitiveness in several roadmaps. Industry actors mentioned that high uncertainty around the market for fossil-free fuel, and whether the producers of fossil-free products can get a return on their investments, are challenges to accelerating transition. A shortage of fossil-free energy solutions and renewable energy sources, limited technology solutions, disadvantageous economic factors, insufficient investment into research, and obstructive regulation are among other challenges to making progress towards net zero by 2045.

Strategies for implementation: In response to the challenges, obstacles, and policy needs identified in the Swedish industry transition roadmaps, FFS has developed strategies related to battery value chain, hydrogen, biomass and finance to foster fossil-free competitiveness.

The FFS roadmaps are developed in bottom-up and sector-led processes with broad participation and stakeholder engagement in the respective sectors. By taking an objective stance as the facilitator and coordinator, FFS was able to act as a bridge between a variety of different actors to reach consensus on goals, targets, and commitments.

Lessons learnt from the FFS road mapping process also highlight the advantages of public-private partnership for decarbonization of industries for all actors involved. In such a collaboration, the industry actors were given consultation, guidance, and clear instructions on how to achieve targets, while also gaining legitimacy via their connection with the government. Government actors were also informed through connections with industry sector partners on how they can support transition by putting incentives and enablers in place (e.g. taking risks in investment decisions, shortening permit application processes for electricity grid expansion, making a CCS initiative possible).

Regeringens klimapartnerskaber (Danish Government’s Climate Partnerships)

In November 2019, the Danish Prime Minister established 13 climate partnerships covering all of Denmark’s business sectors – including energy-intensive industry, construction and energy. The goal of the partnerships was to bring companies together to explore and define how their sectors could contribute to Denmark’s 2030 target to cut carbon emissions by 70% below 1990 levels, while supporting Danish competitiveness, exports, jobs, welfare and prosperity. The partnerships were led by CEOs representing their industry sectors, who were given the autonomy to develop concrete proposals. In particular, each partnership was asked to develop a sectoral roadmap which included ambitions within the sector; contributions to other sectors; and contributions to international targets and value chains.

The climate partnerships initiative provided an opportunity for businesses to strengthen Denmark’s traditionally export-oriented economy, and to raise Denmark’s global reputation as a climate pioneer. With regards to exports, the government acknowledged that the green transition in Danish industry was already in progress while setting up the climate partnerships. This included the export of sustainable solutions across the world by Danish companies such as Ørsted (renewable energy), Vestas (wind turbines), Grundfos (water pumps), Danfoss (cooling and heating) and others. It therefore made political and business sense for the climate partnerships to be led by businesses so that their proposal could reflect the expertise gained from their own green transitions, as well as their buy-in.

By the summer of 2020, the climate partnerships had fulfilled their objectives of delivering 13 sectoral roadmaps. A summary of the proposals put forward by three climate partnerships is provided below.

Proposals for energy-intensive industry

- Switching to biogas: increased access to biogas with competitive prices can ensure the switch from fossil fuels to biogas.

- Production and demand for sustainable solutions: introducing more climate-friendly products requires increased demand and often also willingness to pay a higher price.

- CO2 capture of the largest point emitters: a national plan to mature CO2 capture in a pilot project at one of the largest point emitters in Denmark.

- Increased use of surplus heat: surplus heat from energy-intensive companies can be utilized in the district heating network and reduce emissions from cogeneration plants.

Proposals for construction and buildings

- Lower energy consumption with intelligent energy management and energy renovations.

- Scrap fossil fuels burners and move to green heating in buildings.

- Prepare CO2 accounts for all buildings, bridges and roads.

- Electrify gas- and diesel-powered equipment for fossil-free building sites.

- Introduce energy labelling for all buildings.

Proposals for energy and utilities

- Set a guiding target of reducing carbon emissions from the energy and utilities sector by at least 95%.

- Set a guiding target of reducing the total use of fossil fuels for buildings, transport and industry by 50%.

- Prepare a guiding 10-year roadmap for hydrogen-based fuels, focusing on how government and industry can work together to reduce start-up costs and costs of use.

- Set a target for build-out of renewable energy ensuring sufficient capacity to support a complete, green transformation of Denmark.

- Define a framework for build-out of the Danish energy infrastructure to support a complete, green transformation of Denmark.

Besides the specific actions proposed by each roadmap, as a whole the roadmaps highlight the need for a new “green social contract” or partnership between business and government to secure the policies and investment required to achieve Denmark’s climate target. Although much of the progress towards the 2030 target will be based on the replacement of fossil fuels with renewable energy and electrification, the sectoral roadmaps call for the incubation and development of innovative green technology (e.g. hydrogen, biogas, carbon capture), to reach carbon neutrality by mid-century. In turn, this requires a strong policy framework which balances incentives and disincentives over time to drive demand for low-carbon solutions through changes in consumer behaviour. However, the need for investment decisions to be made long before demand arises introduces uncertainty and risk. The roadmaps call for risk-sharing solutions to facilitate large investments, in addition to building trust that green investments based on existing policies will not be compromised in future. In sum, government is asked to set the strategic direction on policy and investment.

On the basis of the sectoral roadmaps produced by the climate partnerships, the Danish government developed and launched its strategy for climate action, A Green and Sustainable World, in October 2020. This strategy builds on the actions proposed in the sectoral roadmaps by committing itself to further action to promote green transitions in tandem with green exports. It also sets the public-private collaboration approach adopted in the climate partnerships as a model for others to emulate.

Korean New Deal

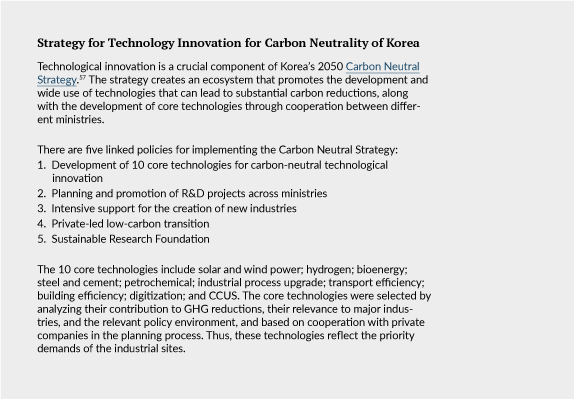

The Korean government views the hydrogen economy as a new growth engine for the country, which has entered an era of low growth. If this and other growth engines are supported, the potential for shared growth in related industries and companies is very large. In addition, competition for hydrogen technology development is fierce worldwide, but as it remains in its early stages, it is estimated that if bold investment and support are activated, Korea can become a global leader in the hydrogen economy. Thus, the government is accelerating the transition to a hydrogen economy by preemptively establishing legal frameworks for one.

The successful implementation of hydrogen economic policies has convinced the Korean Government that it can kill two birds with one stone: climate change response and economic growth.

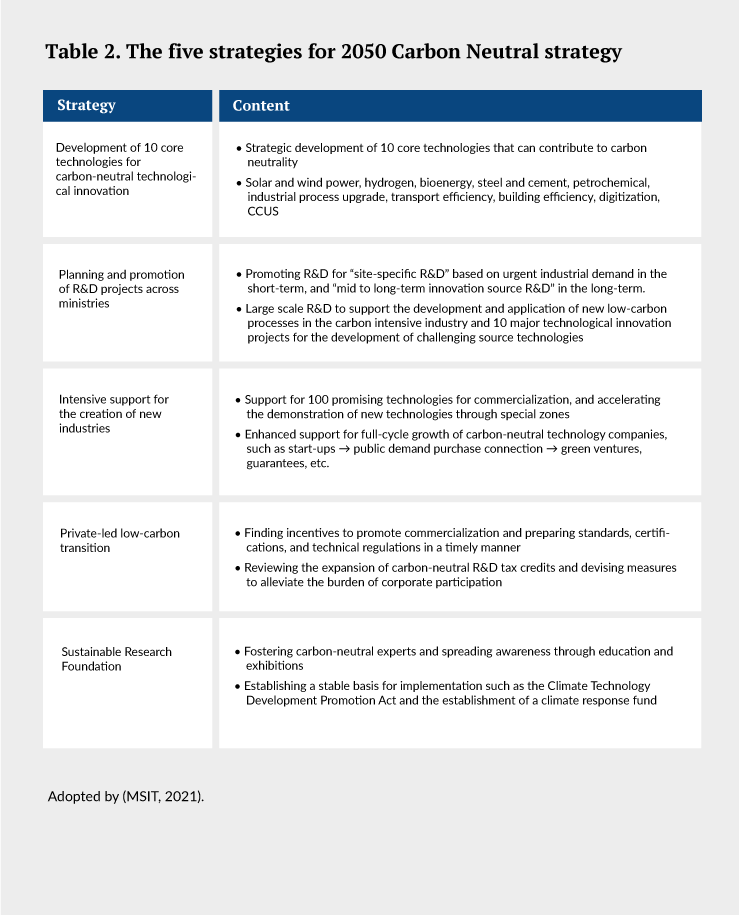

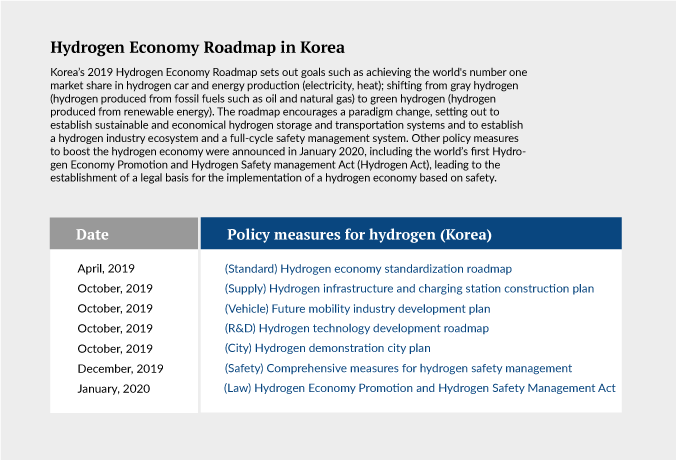

2020 saw Korea significantly step up its commitment to ambitious climate action. The 2050 Carbon Neutral Strategy of the Republic of Korea was unveiled, setting the target of net zero carbon emissions for Korea by 2050. This bold objective will be supported by the Korean New Deal – National Strategy for a Great Transformation, which sets a clear direction for a resilient and low-carbon post-COVID-19 recovery, geared toward economic competitiveness, decarbonization and social justice. The 2050 Carbon Neutral Strategy of Korea and the Korean New Deal are the two documents that lay out the policy framework for achieving the decarbonization of the country’s economy, including the industry sector, which accounts for approximately 37% of Korea’s total GHG emissions. Korea’s NDC target is to cut GHG emissions by 24.4% below 2017 levels by 2030 (which equates to 536 million tons CO2 equivalent). This will be done by implementing a set of reduction strategies for sectors including power, industry, buildings and transportation, and taking additional measures including building carbon sinks by planting forests and reducing emissions from overseas projects.

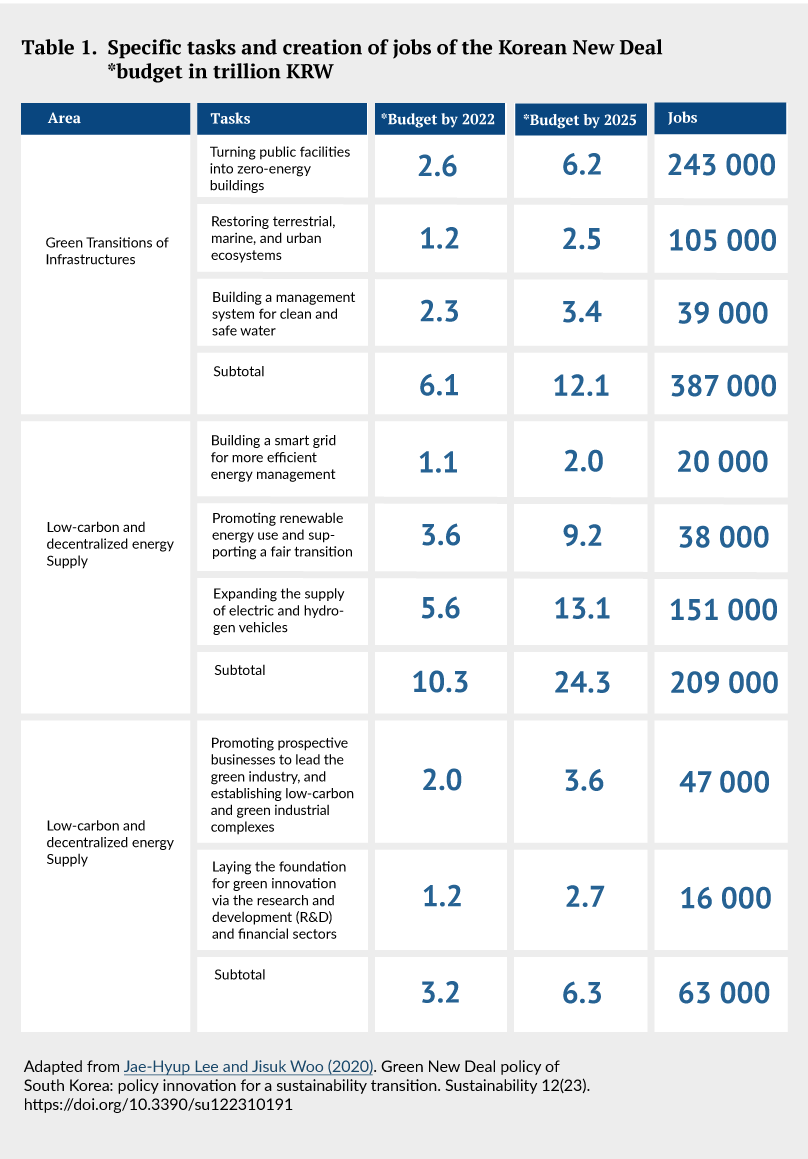

As part of the Korean New Deal, the government intends to invest 73.4 trillion KRW to create 659 000 jobs. The Deal earmarks 30.1 trillion KRW to finance the transition to green infrastructure, in particular the shift toward green and energy-efficient public building through renewable energy equipment and high-performance insulation. Another 35.8 trillion KRW will be invested to speed up the development of a low-carbon and decentralized energy supply. Specific tasks include the establishment of a smart grid for efficient energy management, the supply of electric and hydrogen vehicles and the acceleration of eco-friendly conversion of old diesel vehicles and ships.

Lastly, 7.6 trillion KRW will be invested in innovation for green industry, to incentivize prospective businesses to lead the green industry and establish low-carbon and green industrial complexes. A loan of 1.9 trillion KRW will be introduced for the green sector, to encourage investments in preventing the environmental pollution of businesses, and a joint fund made up by the public and the private sectors will be set up for 215 billion KRW to foster green businesses. Detailed information is provided in Annex II.

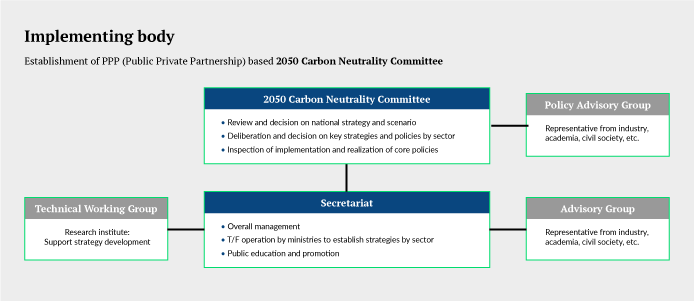

As the implementing body for the carbon-neutral strategy, a committee was established in November 2020 on Korea’s stated goal of going carbon-neutral by 2050 as part of a “strong pan-governmental system”. The Carbon Neutrality Committee is a public-private committee that is proactively responding to the global crisis through collaboration and partnerships, aiming to achieve carbon neutrality, economic prosperity and better quality of life for the people. The scheme will pay particular attention to increasing and improving renewable energy, hydrogen, and energy IT to accelerate the transformation of the country.

The committee will consist of three groups: the secretariat, technical working group and the advisory group. The three groups will review and decide on national strategies and scenarios and take part in decisions, especially key decisions in policies by sector. The body will also ensure that these policies are implemented and realized. Most importantly, the committee has promoted to use the public private partnership mechanism to foster the vision of carbon neutrality. An example is the partnership with Hyundai Motor Group, which is building their technology, infrastructure, and capacity around the carbon-neutral strategy by increasing the production of electric vehicles.

Conclusions

Investments in infrastructure and industrial assets required to transition heavy industry to net-zero are not large compared to global savings and investment, if new financing mechanisms are developed. One way to address this is through co-financing national funds for just transitions through capital from both domestic banks and international finance institutions. Industry transition can be facilitated through partnership, technology diffusion and knowledge exchange between the private and public sectors. In this briefing, we have highlighted some of the policy mixes and kinds of partnership that are becoming widespread around the world, such as bottom-up road mapping, GPP, market-based emissions trading systems and the development of industrial hubs.

The briefing shows that industry transitions are taking place. Companies are partnering up in making green products from green energy. For instance, Volvo recently announced a new partnership with SSAB and Hybrit to be fossil-free by 2030. And the Sweden+Korea Green Transition Alliance was launched in April 2021. In this alliance 13 Swedish companies in Korea hope to share and exchange their knowledge with other Korean companies and help to build up an innovative environment to achieve a green transition. And governments are partnering on mission-oriented innovation initiatives. Indeed, international cooperation is gaining momentum to bring industrial emissions from 30% to net-zero. The Leadership Group for Industry Transition is providing an arena for public-private collaboration, bringing together 15 governments and 16 companies from around the world.

International summits such as P4G, hosted by Korea on 28 May 2021, provide a platform for the transfer of knowledge and know-how, and for the emergence of new partnerships among public and private actors. This study forms part of the proceedings of the Summit.

Annex I: Energy sources and technologies fact-box

Hydrogen

The production of steel, aluminium, cement, and chemicals all require high temperature heat in their industrial processes. The source of this heat is currently based on fossil fuels. Many heavy industries also use fossil-based hydrogen as a feedstock. Research shows that hydrogen can reduce emissions for heavy industry. Indeed, renewable hydrogen can play a role in the decarbonization of aviation and heavy-duty transport and can also be used as a feedstock in refineries and other industrial processes, such as steel-making, replacing coke as a fuel for high-temperature heat and the use of fossil-fuel based hydrogen. As a consequence, hydrogen can contribute to the reduction of industrial emissions. Some of the most important challenges to hydrogen include: the scaling-up of hydrogen production and the development of international certificate schemes (guarantees of origins) for its cross-border trade. And this calls for public-private partnership.

CCUS

While for many industries, energy inputs are the main source of emissions, in some industries, the conversion of raw materials into intermediate or final products also results in process emissions. For instance, process emissions are unavoidable from the calcination process that is needed for production of clinker in cement making. Process emissions account for almost two thirds of total emissions from cement production. Similarly, in steelmaking the use of coking coal and limestone results in process emissions. In the absence of breakthroughs in concrete and cement chemistry, carbon capture, utilization and storage (CCUS) technology will likely be the only solution for abating process emissions. Investment in large scale CCUS is still very modest. Therefore, direct electrification and utilizing existing biomass production capacity continues to play a crucial role for decarbonization of the heavy industry.

Renewable electricity

Decarbonization of heavy industries will require a significant ramp-up of the use of renewable electricity. Demand for electricity from low-carbon sources is expected to grow faster than any other any carrier. At the same time, renewable electricity costs are still high in some parts of the world, and production capacity would need to be increased significantly for electrification of industry on a wide scale, decarbonization industrial heating and to produce renewable hydrogen at scale. Energy companies and utilities need to be encouraged to invest in infrastructure necessary to decarbonize the global economy. At the same time, problems of intermittency with wind and solar would need to be tackled through improved storage technologies. Scaling up availability of renewable electricity for decarbonization calls for greater strategic coordination, public-private partnership and increased investment in generation, network infrastructure, storage and other flexibility services.

Biogas

Another green energy source relevant for scaling up low-carbon industrial processes is biogas, which refers to gas produced by making use of biomass, such as manure, waste and other products or landfill and silt gas. Biogas has historically been used in electricity production, heating and cooking and recently as a replacement to natural gas. Many biogas and small-scale biomethane plants are already operating. Sustainably-produced biogas could contribute to security of supply and play a role in industry transitions, replacing the use of fossil fuels and feedstocks. The future of biomethane and biogas is linked with wider strategies and future role of gas infrastructure, and possible synergies between different energy carriers, electricity, hydrogen and biogas. It also calls for predictable public policy landscape and off-take commitments from the private sector to enable scaling-up of biogas production.

Annex II

Korea New Deal and Carbon Neutral Strategy

Annex III

Korea New Deal and Carbon Neutral Strategy